Ethereum is making big changes. Perhaps the most important is the jettisoning of the “miners” who track and validate transactions on the world’s most-used blockchain network. Miners are the heart of a system known as proof of work. It was pioneered by Bitcoin and adopted by Ethereum, and has come under increasing criticism for its environmental impact: Bitcoin miners now use as much electricity as some small nations. Along with being greener and faster, proponents say the switch, now planned to be phased in by early 2022, will illustrate another difference between Ethereum and Bitcoin: A willingness to change, and to see the network as a product of community as much as code.

1. How are Bitcoin and Ethereum transactions tracked?

Cryptocurrencies wouldn’t work without a new type of technology called blockchain that performs an old-fashioned function: maintaining a ledger of time-ordered transactions. What’s different from pen-and-paper records is that the ledger is shared on computers all around the world and operated not by a central authority, like a government or a bank, but by anyone who wants to take part. Satoshi Nakamoto is the mysterious and still-unknown creator of Bitcoin and its blockchain. What Nakamoto accomplished through the proof of work system was solving the so-called double-spend problem that plagued earlier digital cash projects: Because the blockchain records every single transaction on its network, someone trying to reuse a Bitcoin that has already been spent would be easily caught.

2. What is proof of work?

Proof of work systems existed prior to Nakamoto’s 2008 Bitcoin white paper, but the concept had never been put to such grand use. In Bitcoin and Ethereum today, transactions are grouped into “blocks” that are verified and published to a public “chain” every few minutes. The proof of work necessary to publish the latest block is done by miners whose computers perform millions of trial and error computations to change a given input into a required output. The first miner who succeeds in producing the required output shares it with the network, which checks to see if it works, and is rewarded for the effort with free cryptocurrency. The system also sets a floor of value on the coins -- no one would invest the electricity, computer hardware and other expenses of mining unless coins are worth at least that

3. What are the problems with it?

When Bitcoin was barely known and worth pennies, mining was also cheap. But as its value rose, an arms race of a sort set in, as miners poured in resources in the quest to be the first to validate a block and win new coins. As a result, the system’s electricity usage is now enormous: Researchers at Cambridge University say that the Bitcoin network’s annual electric bill often exceeds that of countries such as Chile and Bangladesh. This has led to calls from environmentally conscious investors, including cryptocurrency booster Elon Musk and others, to shun Bitcoin and Ethereum and any coins that use proof of work. It’s also led to a growing dominance by huge, centralized mining farms that’s antithetical to a system that was designed to be decentralized, since a blockchain could in theory be rewritten by a party that controlled a majority of mining power.

4. What is proof of stake?

The idea behind proof of stake is that the blockchain can be secured more simply if you give a group of people carrot-and-stick incentives to collaborate in checking and crosschecking transactions. It works like this:

* Anyone who puts up, or stakes, 32 Ether can take part. (Ether, the coin used to operate the Ethereum system, reached values of over $4,000 in May.)

* People in that pool are chosen at random to be “validators” of a batch of transactions, a role that requires them to order the transactions and propose the resulting block to the network.

* Validators share that new chunk of blockchain with a group of members of the pool who are chosen to be “attestors.” A minimum of 128 attestors are required for any given block procedure.

* The attestors review the validator’s work and either accept it or reject it. If it’s accepted, both the validators and the attestors are given free Ether.

5. What are the system’s advantages?

It’s thought that switching to proof of stake would cuts Ethereum’s energy use, estimated at 45,000 gigawatt hours by 99.9%. Like any other venture depending on cloud computing, its carbon footprint would then be only be that of its servers. It also is expected to increase the network speed. That’s important for Ethereum, which has ambitions of becoming a platform for a vast range of financial and commercial transactions. Currently, Ethereum handles about 30 transactions per second. With sharding, Vitalik Buterin, the inventor of Ethereum, thinks that could go to 100,000 per second.

6. What are its downsides?

In a proof of stake system, it would be harder than in a proof of work system for a group to gain control of the process, but it would still be possible: The more Ether a person or group stakes, the better the chance of being chosen as a validator or attestor. Economic disincentives have been put in place to dissuade behavior that is bad for the network. A validator that tries to manipulate the process could lose part of the 32 Ether they have staked, for example. Wilson Withiam, a senior research analyst at Messari, a crypto research firm, who specializes in blockchain protocols, said the problem lies at the heart of the challenge of decentralized systems. “This is one of the most important questions going forward,” he said. “How do you help democratize the staking system?”

7. How else is Ethereum changing?

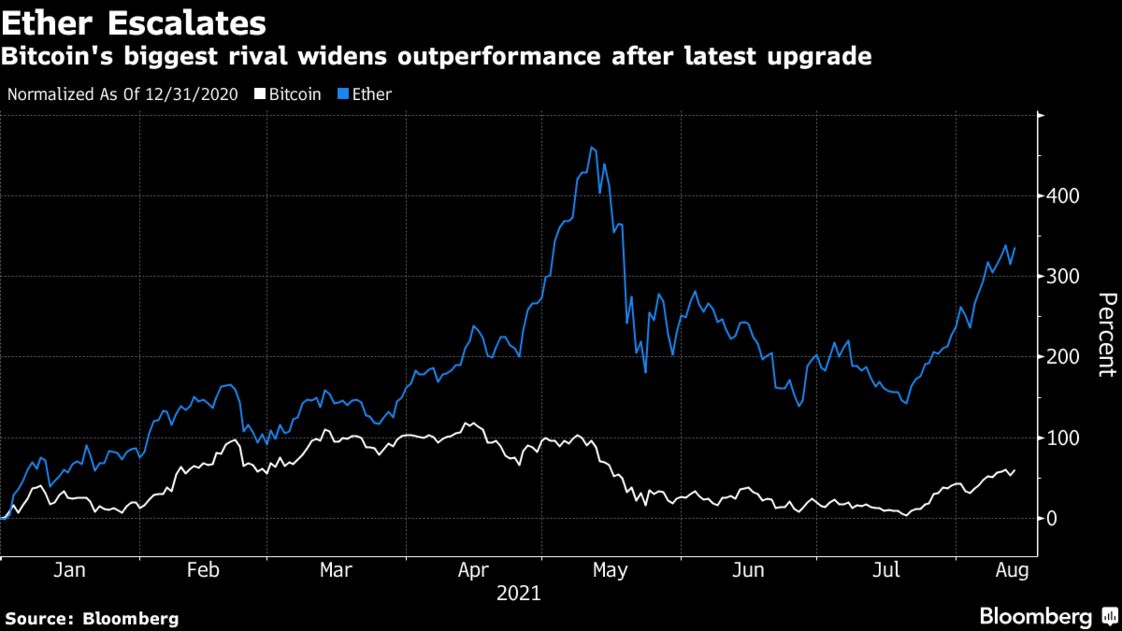

The most recent change was called the London hard fork, which went into effect in early August. The biggest change to the Ethereum blockchain since 2015, the London hard fork included a fee reduction feature called EIP 1559. The fee cut reduces the supply of Ether as part of every transaction, creating the possibility that Ethereum could become deflationary. As of mid-August, 3.2 ether per minute were being destroyed because of EIP 1559, according to tracking website ultrasound.money. That could put upward pressure on the price of Ether going forward. Another change in the works is called sharding, which will divide the Ethereum network into 64 geographic regions. Transactions within a shard would be processed separately, and the results would then be reconciled with a main network linked to all the other shards, making the overall network much faster.

The Reference Shelf

amoun

Blogger Comment

Facebook Comment